ahmadmaulinnaufa

Dec 28, 2016

Graduate / Apply to get many knowledges, supervisions, materials, networkings, tools, and methodologies [2]

My name is Ahmad Maulin Naufa, I graduated from Universitas Gadjah Mada Yogyakarta Indonesia, I got Master of Science in Management (M. Sc) on April, 2016 with the fastest time in my department (1 Year 7 Months), and GPA 3.57. My prior study was Universitas Diponegoro Semarang Indonesia, Bachelor of Animal Science and Agriculture, particularly Nutrition and Feed, the GPA 3.27. Although taking nonlinear field, I supposed I would prefer to study in The Business Management, rather than in The Husbandry Field. In addition, management practically could be implemented on the various subjects, I taught the effectiveness and the efficiency in both of them.

I have worked in some small business such as Pasteurized Milk Farming in Faculty of Animal Agriculture, Universitas Diponegoro as Distributor. Then, I moved to Cassava Cracker Business with the same position. The following job was teacher in the courses, which taught students in the Junior School until Senior High School. The Next, I become laboratory assistant in The Laboratory of Nutrition and Feed, following by becoming an assistant of The Head of Animal Husbandry Department. The last, I created and run a start-up business-UNDIP OJEG-which serves many services such as ojeg (pick someone from a place to other places by motorcycle), rent a motorcycle, travelling, delivering foods and goods, teaching of riding motorcycle, and buying ticket. That business serves 24 hours, the riders are male and female who are students at University from various faculties, now the drivers are 60. The business is running up to the present. I felt enjoy, I realized that my passion is business, therefore choosing business as my choice.

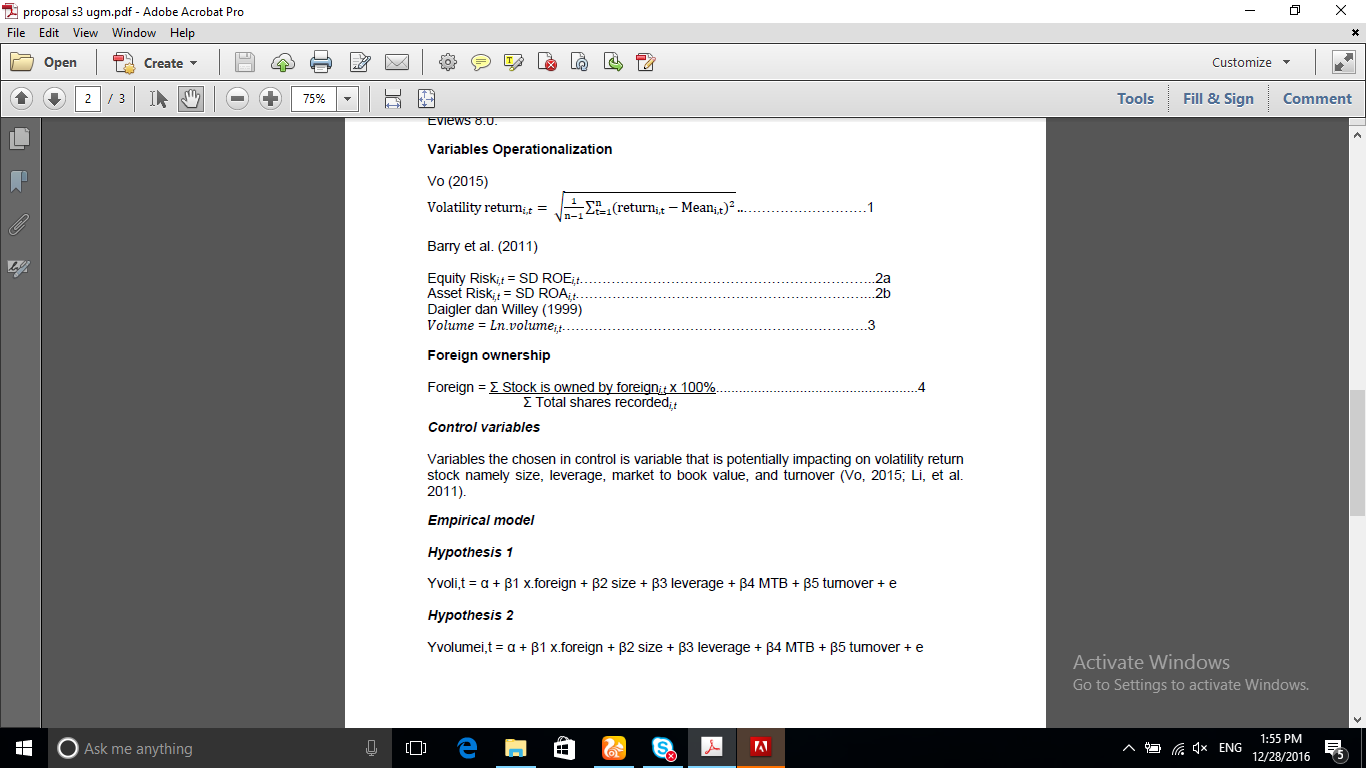

My previous research in my Bachelor was "Relative Weight of Digestive Organs in Kedu Chicken was Influenced by Different Level of Protein". Moreover, my research in Master program was "Foreign Ownership, Return Volatility, Volume, and Risk of Stock in Indonesia".

I want to learn about business management and my career goal is business, particularly becoming lecturer in Business Department in the University. Therefore I applied in some of universities in Indonesia, but I could not be accepted, perhaps the reason was I did not have linear degrees both my Bachelor Degree and Master Degree. The regulation from Minister which regulated minimum requirement becoming a lecturer is having 2 linear degrees, so I have to get Ph. D Degree in Management by studying in Doctoral Program particularly at Birmingham. The other reasons are I would like to enhance my previous subject from Indonesia to ASEAN countries, publishing my paper to one of Top Tier Journal, and getting advanced knowledge from Professor / Supervisor from another country.

I guess if I accepted in Ph. D, I would get many knowledges, supervisions, materials, networkings, tools, and methodologies which will help me to enhance my thesis master subject, to be published in Top Journal, and to make myself suitable as a Lecturer with Doctoral Honor.

The research subject I want to learn more is Financial Management, that is The Stock, particulary how The Relationship of Foreign Ownership to The Performances of Stock, including The Volatility of Return, The Volume, and The Risks. It would be better if I will observe not only in Indonesia, but also in ASEAN Countries. The finance research regarding the stock is interesting to explore, especially in the stock. The issue of this research is foreign ownership, the differences among researcher findings upon the influence of foreign ownership effect on volatility return are still found. On one side, foreign ownership increases volatility returns while on the other side it might decrease, but there are also some who find that it does not affect anything. The same thing happens with volume and fundamental risk. The aims of this research are to test the effect of foreign ownership on volatility return, volume and risk of stock in ASEAN countries. The significance of this topic is important to test, whether the foreign ownership gives the benefits or loss in ASEAN countries Stocks. The research outcomes are expected to gain empirical information about foreign ownership effect, could be used to understand developing research in the same field, and become the one of consideration source in capital market policy making.

The underlined reason is my previous research especially Master Thesis was closely related to the area of research interest, but more specific to foreign ownership, volatility return, risk, and volume in the Indonesian Stock. It was just focused on one country, which has particular regulation. The basic idea comes from after globalization opening market has influenced Capital Market in Indonesia to be opened to foreign ownership, whether it might bring positive or negative impact on the stock performance or risk, so I tested on the volatility return, risk, and volume as independent

variables.

My name is Ahmad Maulin Naufa, I graduated from Universitas Gadjah Mada Yogyakarta Indonesia, I got Master of Science in Management (M. Sc) on April, 2016 with the fastest time in my department (1 Year 7 Months), and GPA 3.57. My prior study was Universitas Diponegoro Semarang Indonesia, Bachelor of Animal Science and Agriculture, particularly Nutrition and Feed, the GPA 3.27. Although taking nonlinear field, I supposed I would prefer to study in The Business Management, rather than in The Husbandry Field. In addition, management practically could be implemented on the various subjects, I taught the effectiveness and the efficiency in both of them.

I have worked in some small business such as Pasteurized Milk Farming in Faculty of Animal Agriculture, Universitas Diponegoro as Distributor. Then, I moved to Cassava Cracker Business with the same position. The following job was teacher in the courses, which taught students in the Junior School until Senior High School. The Next, I become laboratory assistant in The Laboratory of Nutrition and Feed, following by becoming an assistant of The Head of Animal Husbandry Department. The last, I created and run a start-up business-UNDIP OJEG-which serves many services such as ojeg (pick someone from a place to other places by motorcycle), rent a motorcycle, travelling, delivering foods and goods, teaching of riding motorcycle, and buying ticket. That business serves 24 hours, the riders are male and female who are students at University from various faculties, now the drivers are 60. The business is running up to the present. I felt enjoy, I realized that my passion is business, therefore choosing business as my choice.

My previous research in my Bachelor was "Relative Weight of Digestive Organs in Kedu Chicken was Influenced by Different Level of Protein". Moreover, my research in Master program was "Foreign Ownership, Return Volatility, Volume, and Risk of Stock in Indonesia".

I want to learn about business management and my career goal is business, particularly becoming lecturer in Business Department in the University. Therefore I applied in some of universities in Indonesia, but I could not be accepted, perhaps the reason was I did not have linear degrees both my Bachelor Degree and Master Degree. The regulation from Minister which regulated minimum requirement becoming a lecturer is having 2 linear degrees, so I have to get Ph. D Degree in Management by studying in Doctoral Program particularly at Birmingham. The other reasons are I would like to enhance my previous subject from Indonesia to ASEAN countries, publishing my paper to one of Top Tier Journal, and getting advanced knowledge from Professor / Supervisor from another country.

I guess if I accepted in Ph. D, I would get many knowledges, supervisions, materials, networkings, tools, and methodologies which will help me to enhance my thesis master subject, to be published in Top Journal, and to make myself suitable as a Lecturer with Doctoral Honor.

The research subject I want to learn more is Financial Management, that is The Stock, particulary how The Relationship of Foreign Ownership to The Performances of Stock, including The Volatility of Return, The Volume, and The Risks. It would be better if I will observe not only in Indonesia, but also in ASEAN Countries. The finance research regarding the stock is interesting to explore, especially in the stock. The issue of this research is foreign ownership, the differences among researcher findings upon the influence of foreign ownership effect on volatility return are still found. On one side, foreign ownership increases volatility returns while on the other side it might decrease, but there are also some who find that it does not affect anything. The same thing happens with volume and fundamental risk. The aims of this research are to test the effect of foreign ownership on volatility return, volume and risk of stock in ASEAN countries. The significance of this topic is important to test, whether the foreign ownership gives the benefits or loss in ASEAN countries Stocks. The research outcomes are expected to gain empirical information about foreign ownership effect, could be used to understand developing research in the same field, and become the one of consideration source in capital market policy making.

The underlined reason is my previous research especially Master Thesis was closely related to the area of research interest, but more specific to foreign ownership, volatility return, risk, and volume in the Indonesian Stock. It was just focused on one country, which has particular regulation. The basic idea comes from after globalization opening market has influenced Capital Market in Indonesia to be opened to foreign ownership, whether it might bring positive or negative impact on the stock performance or risk, so I tested on the volatility return, risk, and volume as independent

variables.