Research Proposal, to pursue Ph.D (Body)

The change of return (volatility) surely can be influenced by many factors, one of those factors is ownership of the stocks. Ownership of stock can be composed of domestic and foreign investors. Vo (2015) said that's foreign can play the role in stabilization and monitor about risk. Foreign also influence the trading volume because of the stock that they have attracted another investor to own (spillover effect) (Agarwall, et al. 2009). Dissimilarity findings among researchers still happen in this field. Foreign has a negative relation (decreasing) with return volatility, because of plays in governance, risk sharing, monitoring, stabilization, and proper financial decision making (Li, et al. 2011; Pambudi and Smyth, 2008; Ang, 2010; and Solnik, 1974). In the one side, foreign ownership has a positive relation (increasing) return volatility because the foreign's stock is easier to influence by global risks. Several prior research found that foreign ownership did not impact to return volatility (Bekaert and Harvey, 1997; De Santis and Imrohoroglu, 1994; Kim and Singal, 2000). The research about a relationship between the foreign ownership and return volatility also happened to volume and risk. The research about foreign many researchers did on the stock return (Dvorak, 2005; Agarwall, et al. 2009), but limited research about return volatility.

The research question is whether the foreign ownership has the effect of return volatility, trading volume and risk of stock in ASEAN countries. Research benefits hopefully can give an empirical contribution about foreign ownership effect to return volatility, volume and risk. This research can also be used for being a reference to understand developing research in the same field. The contribution policy that is expected to give the picture the influence of foreign ownership to return volatility, volume and risks could become one of the considerations the preparation of regulations foreign ownership of in the capital market. For manager give the evidence empirical to be used as consideration in company decision making

We used panel data in accordance Li et al. (2011). Sampling methods using purposive sampling (at least three times exist index), the samples obtained from ASEAN countries Capital Market (Indonesia, Malaysia, Thailand, Philipina, Singapore, Vietnam, Laos, Myanmar, and Kambodia) and elected 500 sample company during 2011-2015. The Analysis using regression (ordinary least square and generalized least square) with Eviews 8.0.

Introduction and Literature Review

The change of return (volatility) surely can be influenced by many factors, one of those factors is ownership of the stocks. Ownership of stock can be composed of domestic and foreign investors. Vo (2015) said that's foreign can play the role in stabilization and monitor about risk. Foreign also influence the trading volume because of the stock that they have attracted another investor to own (spillover effect) (Agarwall, et al. 2009). Dissimilarity findings among researchers still happen in this field. Foreign has a negative relation (decreasing) with return volatility, because of plays in governance, risk sharing, monitoring, stabilization, and proper financial decision making (Li, et al. 2011; Pambudi and Smyth, 2008; Ang, 2010; and Solnik, 1974). In the one side, foreign ownership has a positive relation (increasing) return volatility because the foreign's stock is easier to influence by global risks. Several prior research found that foreign ownership did not impact to return volatility (Bekaert and Harvey, 1997; De Santis and Imrohoroglu, 1994; Kim and Singal, 2000). The research about a relationship between the foreign ownership and return volatility also happened to volume and risk. The research about foreign many researchers did on the stock return (Dvorak, 2005; Agarwall, et al. 2009), but limited research about return volatility.

The research question is whether the foreign ownership has the effect of return volatility, trading volume and risk of stock in ASEAN countries. Research benefits hopefully can give an empirical contribution about foreign ownership effect to return volatility, volume and risk. This research can also be used for being a reference to understand developing research in the same field. The contribution policy that is expected to give the picture the influence of foreign ownership to return volatility, volume and risks could become one of the considerations the preparation of regulations foreign ownership of in the capital market. For manager give the evidence empirical to be used as consideration in company decision making

Research Method

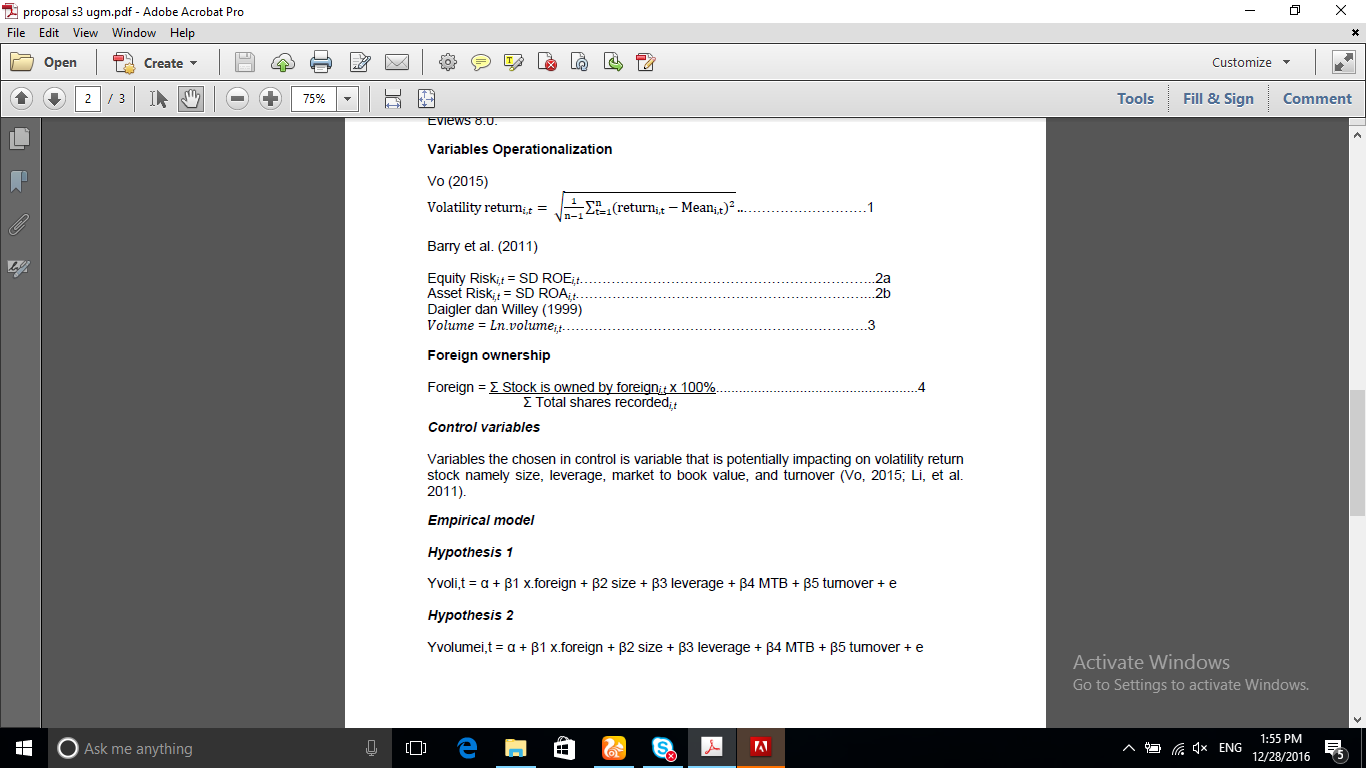

We used panel data in accordance Li et al. (2011). Sampling methods using purposive sampling (at least three times exist index), the samples obtained from ASEAN countries Capital Market (Indonesia, Malaysia, Thailand, Philipina, Singapore, Vietnam, Laos, Myanmar, and Kambodia) and elected 500 sample company during 2011-2015. The Analysis using regression (ordinary least square and generalized least square) with Eviews 8.0.

20161228.png